GPI Slows In July

Global Purchasing Index

By Victoria Fraza Kickham, Distribution Editor

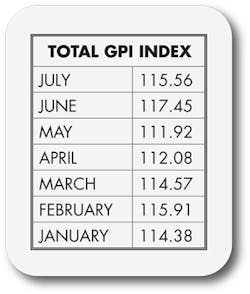

A monthly benchmark that gauges purchasing professionals’ views on procurement activity in the electronic components marketplace. A reading below 100 indicates pessimism; a reading above 100 indicates optimism.GPI Slows in July

Following a rebound in June, the Global Purchasing Index takes a 1.6% drop in July but remains in positive territory as purchasing managers cite spotty business conditions.

After reaching a six-month high in June, the Global Purchasing Index slipped in July as purchasing managers reported a drop in purchasing activity and increasing prices during the month. Launched this past January, the GPI measures purchasing managers’ business confidence monthly.115.6, it remained above May’s all-time low of 111.9 and continues its upward climb out of the springtime slump. GPI panel members characterize the business climate as “very sporadic” and “challenging.”

“The challenging market environment has compelled us to adapt by implementing new marketing strategies,” one panel member said.

“[Business is] very sporadic,” another panel member noted. “[But we are] seeing more engineering inquiries.”

Overall, GPI panel members reported an increase in new orders, inventories and pricing in July along with a drop in purchasing activity and slightly shrinking lead times.

Panel members reported that inventory levels remained high, though, with the inventories index reaching an all-time high of 2.19, a 2% increase over June.

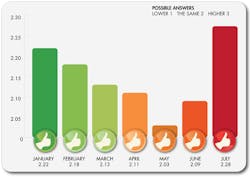

New Orders Continue to Climb, Inventories Grow

Despite the overall dip in the GPI, purchasing managers say new orders from customers remain on the rise, increasing 9% over June to a record level of 2.28 (on a scale of 1 to 3) for the month. This represents the first time the new orders index has exceeded its January level of 2.22.Panel members reported that inventory levels remained high, though, with the inventories index reaching an all-time high of 2.19, a 2% increase over June.

GPI panel members reported a 9% increase in new orders during JulyComponent Purchases Slow, Prices Rise

Panel members reported a 7% decline in component purchasing activity in July, nearly reaching the index’s all-time low of 1.98, recorded in April. The GPI prices index rose 2% during the month, as panel members reported increased pricing for some electronic components. Overall, panel members reported shrinking lead times, as the lead time index fell nearly 10% compared to June.

Illustrating the spotty nature of current business conditions, some panel members reported lengthening lead times on certain components.

“[We are] seeing a clear increase in lead times on a number of component types and are receiving formal notification from suppliers,” one panel member said.

Others pointed to an increasingly competitive environment among component suppliers.

“With the decrease in military contract awards, the component distributors appear to be more price conscience and competitive,” one panel member reported. Global Purchasing’s GPI measures purchasing professionals’ business confidence in five areas: new orders from customers; electronic component inventory levels; purchasing activity; pricing; and lead times. Global Purchasing compiles the GPI data monthly from a survey of more than 100 panel members who buy a wide range of electronic components. Prequalified for their industry experience, panel members are purchasing executives, managers, or buyers at original equipment manufacturing (OEM) or contract manufacturing firms around the world.Other areas of the GPI you may be interested in:About the GPI | GPI Panelists | Apply to the GPI | Member of the Month | Article Library

Panel members reported a 7% decline in component purchasing activity in July, nearly reaching the index’s all-time low of 1.98, recorded in April. The GPI prices index rose 2% during the month, as panel members reported increased pricing for some electronic components. Overall, panel members reported shrinking lead times, as the lead time index fell nearly 10% compared to June.

Illustrating the spotty nature of current business conditions, some panel members reported lengthening lead times on certain components.

“[We are] seeing a clear increase in lead times on a number of component types and are receiving formal notification from suppliers,” one panel member said.

Others pointed to an increasingly competitive environment among component suppliers.

“With the decrease in military contract awards, the component distributors appear to be more price conscience and competitive,” one panel member reported. Global Purchasing’s GPI measures purchasing professionals’ business confidence in five areas: new orders from customers; electronic component inventory levels; purchasing activity; pricing; and lead times. Global Purchasing compiles the GPI data monthly from a survey of more than 100 panel members who buy a wide range of electronic components. Prequalified for their industry experience, panel members are purchasing executives, managers, or buyers at original equipment manufacturing (OEM) or contract manufacturing firms around the world.Other areas of the GPI you may be interested in:About the GPI | GPI Panelists | Apply to the GPI | Member of the Month | Article Library