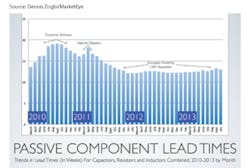

If you are in the electronic components business, either buying or supplying, the sanguinity of your work life is greatly affected by supplier lead times. For interconnect, passive, and electromechanical components (IP&E), lead times have been stable for going on two years (see the chart on passives, below). Now is a good time for a “high five.”

Since lead times are such an important part of any procurement planning equation, this protracted period of stability has moved product availability low down on the list of things for buyers and production planners to worry about, giving them a welcome, extra measure of peace-of-mind. While we are all nice and relaxed, I thought it might be a good time to peel the onion a little on lead-time cause-and-effect.

Every component manufacturer regularly updates its component manufacturing lead times. As a distributor, TTI gets files of lead-time change information every day, which then gets uploaded into our system for use by our product management group. This may come as a surprise to you, but the accuracy of these published lead times varies wildly by product type, supplier, and current industry conditions. So what many systems do, TTI’s included, is measure delivered lead times and factor in an average of recent deliveries into their calculations. These real-time lead times provide a much more accurate picture of product availability trends, especially when contrasted against manufacturers’ published lead times.

In a period like now, when lead times are very stable, the variation in published and actual lead times is minimal and your reorder point calculation can usually do a good job of making sure that you don’t have too few, or too many, parts coming in. But as lead times start to move, look out.

And lead times are starting to move. This year, they have been gradually trending up. As lead times move out, all purchasing systems in the supply chain take note and start to increase order rates. Suppliers love this, as it grows their backlog and provides a longer planning horizon for their own production planners. But the very act of putting more parts on order pushes lead times out even further. And so starts the whip action of the supply chain.

If lead times increase, or decrease, gradually (like now), the whip action is mild and in short order, settles down. If lead times change abruptly and drastically (like after a natural disaster, a strong upward trend in the economy, or the release of a hot new, component-intensive product), the whipping can be lengthy and violent.

The TTI business model and system is designed to shield our customers from the sting of lead-time variation. Our reorder point calculation looks at published lead times (actual and trend) and measured lead times (actual and trend), and uses the greater of the two. In other words, it attempts to overbuy relative to lead-time in order to maintain an on-hand inventory buffer for the customers to draw out of. The objective of the buffer is to create space in which a customer’s purchasing system can adjust itself gradually to changes in product availability.

In addition, there are factors in our equation that serve as gross multipliers of re-order point quantities so that we can instantly react to sudden, sharp changes in lead times, like what occurred after the northern Japan Tōhoku earthquake and tsunami of March 2011.

A great resource for keeping track of IP&E lead times is TTI’s MarketEye website where you will find a section dedicated to this topic. Here we show you exactly what is happening with lead times. There is a section for capacitors, resistors, circuit protection, connectors, discretes, electromechanical, and electro magnetic. Within each are many product subcategories (86 alone for capacitors), all showing current average lead-time and a lead-time trend indicator. Clicking on them brings up a trend chart which lets you know whether to stay calm or worry.

A quick scan of current data reveals that of the 138 product sub-categories we measure lead times for, 94 of them are experiencing some mild increase in lead time (operative word here is “mild”). The remainders are flat, so no lead times are shrinking. Of particular note is capacitors, where more than half are increasing, including large case size HI CV ceramics, most molded tantalums, and all polymers and resistors, where you will find that lead times on thin film, networks, and most mil-spec parts are increasing.

Barring any unforeseen natural disasters in places where electronic components are manufactured, we do not expect any drastic changes in lead times for the remainder of this year. Lead times will probably continue to inch out as the global economy continues to recover, and sectors such as automotive continue to run strong and soak up capacity, but that is manageable. So for now, relax and save your energy.